Efile tax calculator

All tax tools calculators. Up to 10 cash back Check your returns e-file status by entering the information below.

Tax Calculator Estimate Your Taxes And Refund For Free

Tax Return Year Select 2021 2020 2019 Tax Return Type Select 1040 Individual 1065 Partnership.

. With this convenient tax tool you can estimate your refund by using complex set equations with factors. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

E-file fees do not apply to NY state returns. Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Your household income location filing status and number of personal. Our program works to guide you through the complicated filing process with ease helping to.

Discover Helpful Information And Resources On Taxes From AARP. State e-file available for 1995. Get the tax help you need simply by pressing a few buttons.

The calculator will calculate tax on your taxable income only. E-files online tax preparation tools are designed to take the guesswork out of e-filing your taxes. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400.

Personal state programs are 3995 each state e-file available for. Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. The State of Delaware transfer tax rate is 250.

Effective tax rate 172. State e-file not available in NH. Because tax rules change from year to year your tax refund.

Delaware DE Transfer Tax.

Calculate Your Earned Income Tax Credit Or Eitc With This Tool

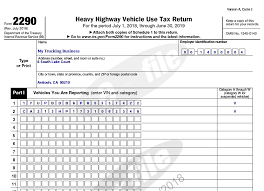

Ytt Llc Form 2290 Efile 2290

Efile Review Pros Cons And Who Should Use It To File Taxes

Tax Calculator Estimate Your Taxes And Refund For Free

Tax Calculators And Forms Current And Previous Tax Years

Paycheck Tax Withholding Calculator For W 4 Tax Planning

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

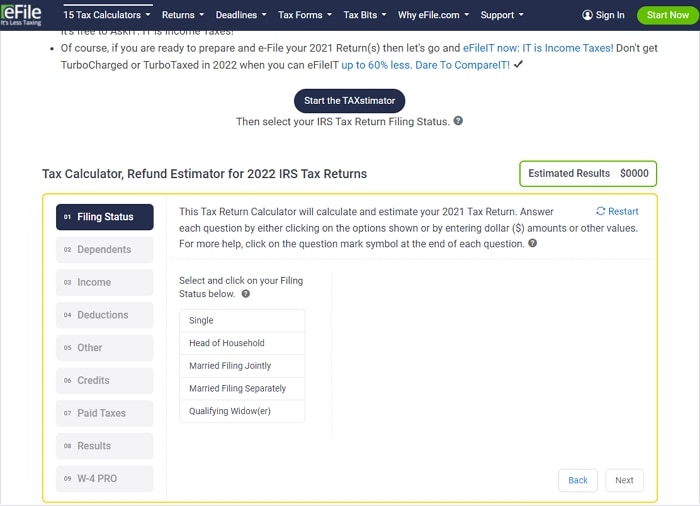

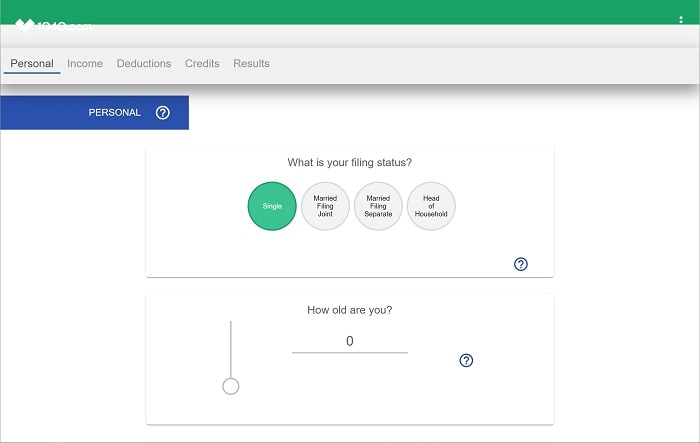

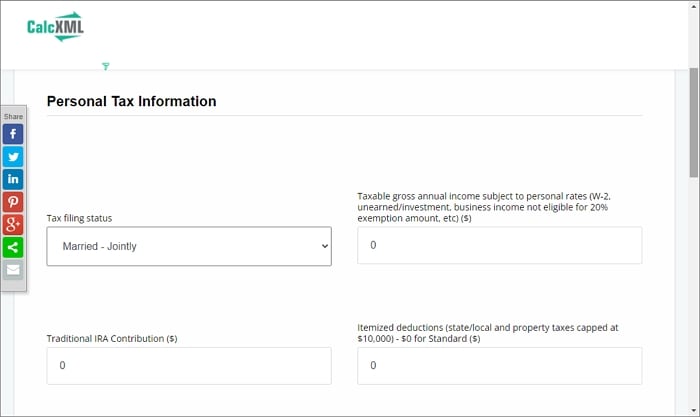

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

Free E File H R Block

Tax Calculators And Tax Forms Estimate And File 2018 Taxes

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

How To Calculate Your Federal Income Tax Refund Tax Rates Org

Tax Year 2022 Calculator Estimate Your Refund And Taxes